| Filed by the Registrant | x | |

| Filed by a Party other than the Registrant | o | |

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 | |

| x | No fee required. | ||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| o | Fee paid previously with preliminary materials. | ||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| (1) | Amount previously paid: | ||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: | ||

| Board Recommendation | |||||

| 1 | Elect two directors, both for a term of three years; | FORMs. Jones and Ms. Mallesch | WHEN May 15, 2019 2:00 p.m. Eastern Daylight Saving Time | ||

| 2 | Vote, on an advisory basis, to approve executive compensation; | FOR | |||

WHERE Libbey Corporate Showroom 335 North St. Clair Street Toledo, Ohio 43604 | |||||

| 3 | Vote to approve the Amended & Restated Libbey Inc. 2016 Omnibus Incentive Plan; | FOR | |||

| 4 | Vote to ratify the appointment of | FOR | |||

RECORD DATE Close of business on March 20, 2019 | |||||

| IN PERSON | VIA MAIL | VIA PHONE | VIA INTERNET | |||

| Attend the Annual Meeting and vote by ballot | Complete, sign, date and return your proxy card in the envelope provided | Call toll-free 1-800-690-6903 | Go to www.proxyvote.com | |||

| A MESSAGE FROM THE LEAD INDEPENDENT DIRECTOR |  |

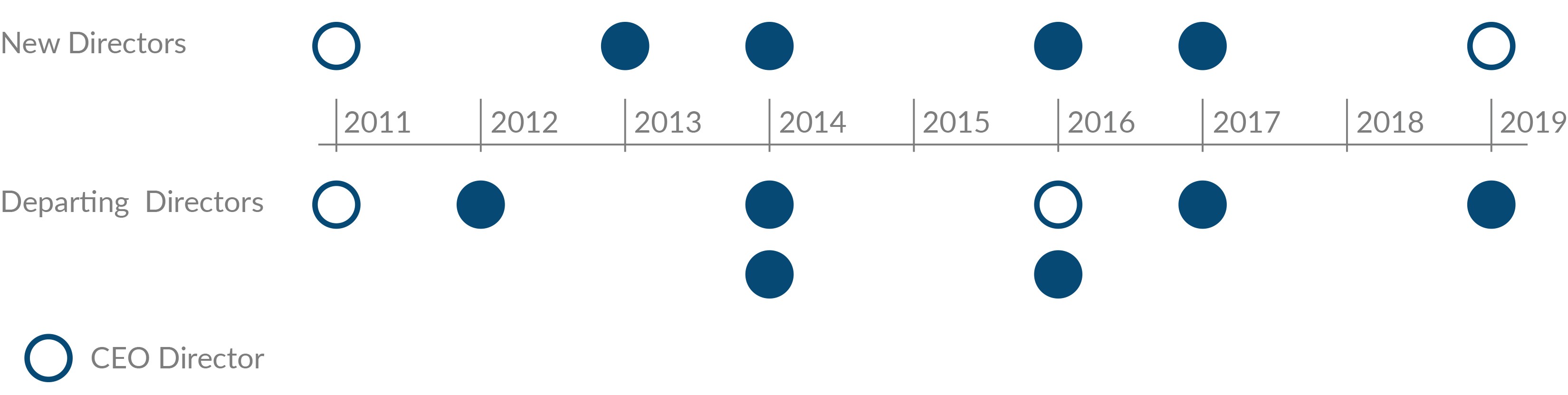

Dear Fellow Shareholders, 2018 marked Libbey’s 200th anniversary. Celebrating such a historic milestone provides an opportunity to reflect on the past and look to the future. We value our shareholders, customers, and employees whose dedication and support during the past two centuries have helped us to become the world’s leading global glass tableware manufacturer. In turning to the next 200 years, we are inspired to accelerate Libbey’s evolution and deliver improved performance and value to our stakeholders. On March 25, 2019, Michael P. Bauer became Libbey’s new Chief Executive Officer, succeeding Bill Foley, who retired from the CEO role effective March 24, 2019. As part of Libbey's succession planning process, which has been underway for some time, we undertook an extensive search and our Board believes that Mike is the ideal candidate to succeed Bill. Mike’s considerable knowledge of manufacturing, marketing, supply chain and finance will complement our business and help us continue to drive profitable growth, operational excellence and organizational excellence. We are confident that Mike, working together with our strong management team, will build upon the momentum created under Bill’s leadership. Bill has overseen a critical period in Libbey's commercial transformation over the past several years, including the creation of our highly successful and expanding e-commerce platform, reinvigoration of a culture of product innovation that is driving new product choices for our customers and significant contributions to net sales, and technology investments that are critical to improving our operational performance. Bill has guided Libbey through a particularly challenging competitive environment, helping to maintain and grow our leading industry position. We sincerely appreciate his hard work and commitment. We are also grateful to continue to have his insights and contributions as Executive Chairman of the Board of Directors. The Board believes that the mix of institutional knowledge and fresh perspectives among our leadership team, combined with the significant progress made toward executing our strategic priorities, makes Libbey poised to deliver future growth and stability. We thank you for your continued support. Sincerely, John C. Orr Lead Independent Director | |

| ORGANIZATIONAL EXCELLENCE | ||||

| Improving marketing capabilities in new product development and innovation to drive profitable growth | Improving operating processes, systems and technology | Building winning teams that foster high performance and live our core values | ||

| • | Our adjusted EBITDA (calculated as shown in Appendix A) for 2018 was $71.0 million, compared to $70.6 million in 2017. |

| Voting Proposals and Board |

| PROPOSAL NO. 1 | |

| ELECTION OF DIRECTORS | |

| Election of Ginger M. Jones and Eileen A. Mallesch as Class II directors | þ |

| GINGER M. JONES, 54 | EILEEN A. MALLESCH, 63 | |||

| Retired, Senior Vice President, Chief Financial Officer of Independent |  | Professional Board Member Director Since 2016 Independent | |

Qualifications • Experience as chief financial officer of a public company with over $2 billion in revenues • Significant executive leadership experience in financial strategy and experience in public audit functions, resulting in her qualification as an audit committee financial expert • Experience in global supply chain Libbey Committees • Audit Chair • Compensation Other Current Public Company Boards • Tronox Limited (NYSE: TROX) | • Public company board and corporate governance experience • Experience with mergers, acquisitions and divestitures • International business experience • Foodservice industry knowledge Libbey Committees • Audit • Compensation Other Current Public Company Boards • Fifth Third Bancorp (NASDAQ: FITB) • State Auto Financial Corp. (NASDAQ: STFC) • Brighthouse Financial, Inc. (NASDAQ: BHF) | |||

| DIRECTOR NOMINEES | |||||||||

| ü | ü | ü | ü | ||||||

| ARE INDEPENDENT | HAVE SIGNIFICANT EXECUTIVE LEADERSHIP EXPERIENCE | HAVE OTHER PUBLIC COMPANY BOARD EXPERIENCE | HAVE FINANCIAL STRATEGY EXPERTISE | ||||||

| Name and Age | Independent | Director Since | Libbey Committees | Other Current Public Company Boards | ||||

Michael P. Bauer, 54 | No | 2019 | None | |||||

| CEO, Libbey Inc. | ||||||||

| No | 1994 | Myers Industries, Inc. | ||||||

| Executive Chairman, Libbey Inc. | ||||||||

Deborah G. Miller, 69 | Yes | 2003 | A | Sentinel Group Funds, Inc. | ||||

| CEO, Enterprise Catalyst Group | N&G | |||||||

Carol A. Moerdyk, 68 | Yes | 1998 | C | American Woodmark Corporation | ||||

| SVP, International, OfficeMax Incorporated (retired) | N&G | |||||||

Steve Nave, 49 | Yes | 2017 | C | None | ||||

| President, CEO and a director, Bluestem Group Inc. (retired) | N&G* | |||||||

John C. Orr, 68 | Yes | 2008 | A | None | ||||

| President, CEO and a director, Myers Industries, Inc. (retired) | N&G | |||||||

| BOARD SNAPSHOT | |||

| INDEPENDENT | TENURE OF LESS THAN 7 YEARS | WOMEN |

6/8 | 4/8 | 4/8 |

|  |  |

| Executive Compensation |

| PROPOSAL NO. 2 | ||||

| ADVISORY SAY-ON-PAY | ||||

We are providing shareholders the opportunity to cast an advisory vote with respect to the following resolution: RESOLVED, that the | ||||

| þ | ||||

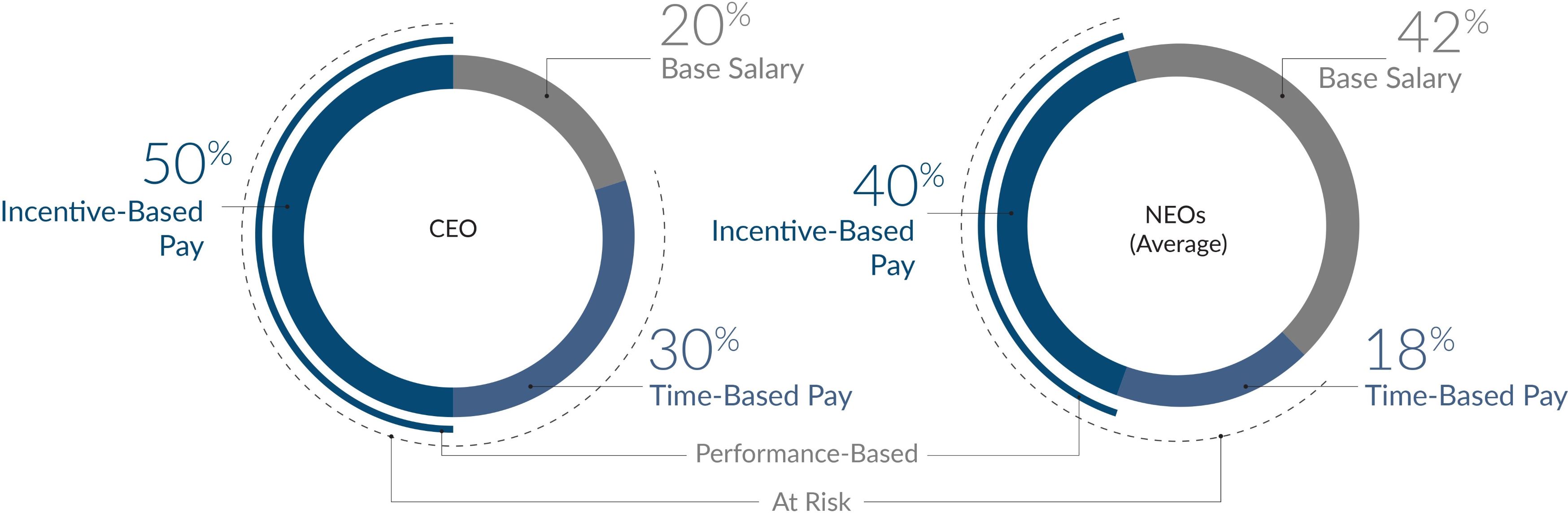

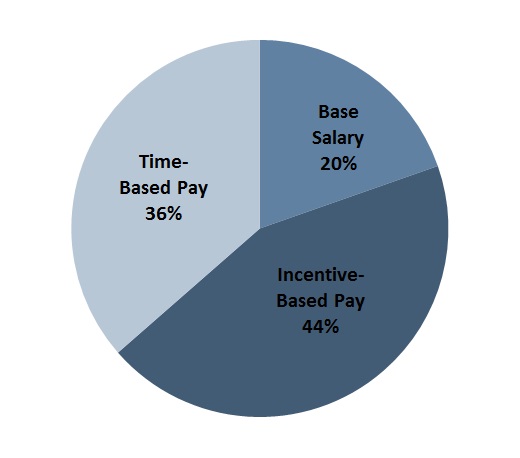

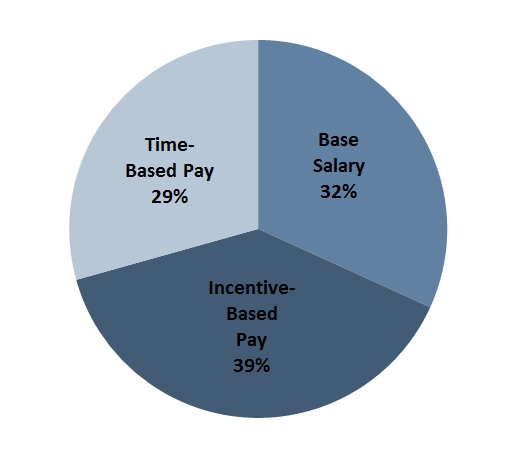

| CEO | Element | Key Characteristics | NEOs | |||||

| 20% | 42% | |||||||

| BASE SALARY | ||||||||

| Base Salary | Fixed component; reviewed annually | |||||||

| 50% | ||||||||

INCENTIVE-BASED PAY (Performance-Based; At Risk) | ||||||||

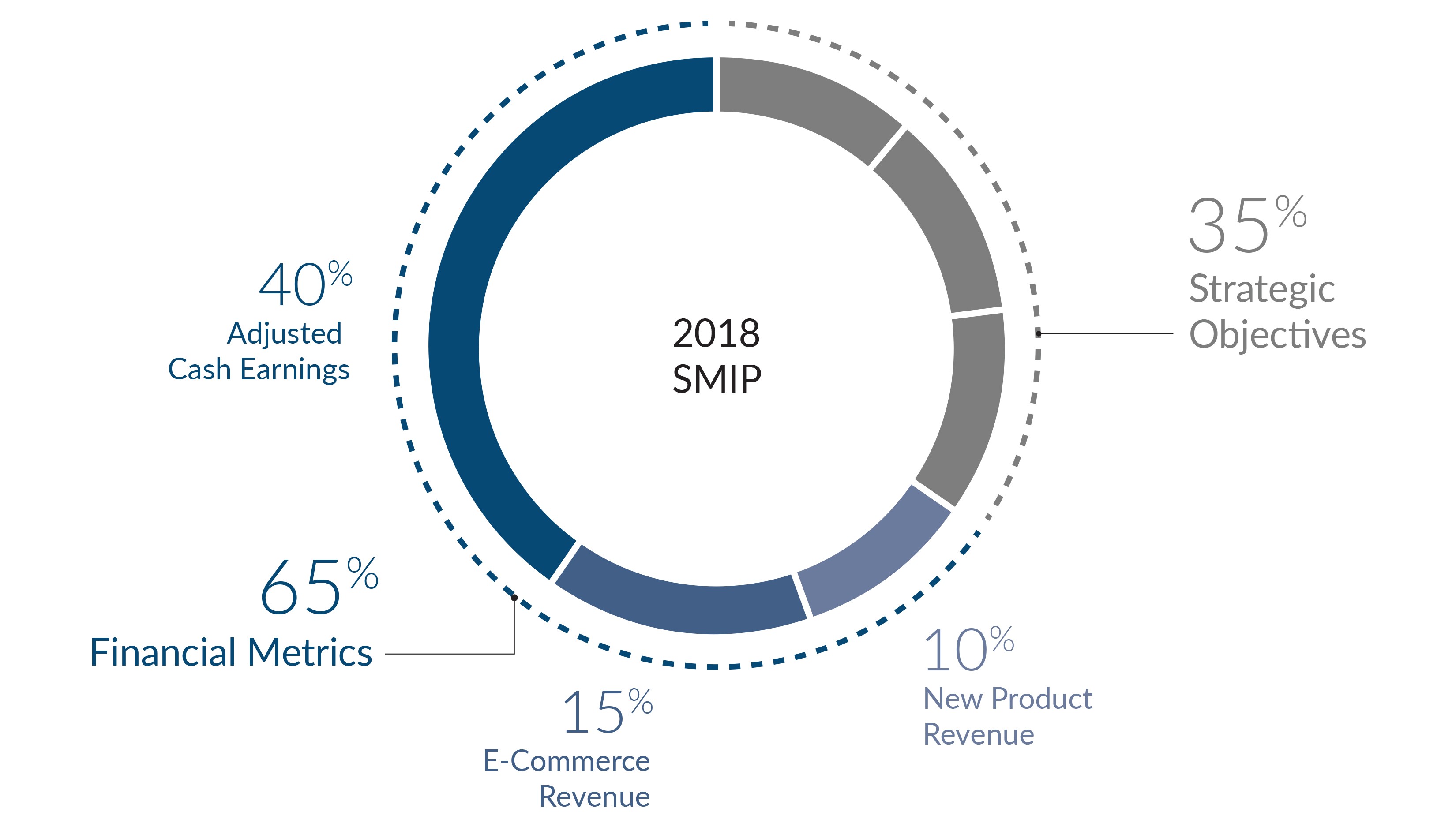

| Annual cash incentive award under our SMIP | At-risk variable pay opportunity for short-term performance; based 65% on financial metrics (40% adjusted cash earnings, 15% e-commerce revenue, 10% new product revenue) and 35% on strategic objectives; no guaranteed minimum payout; maximum payout of 200% of target | |||||||

| 40% | ||||||||

| Long-term performance cash incentive awards under our LTIP | Formula-driven, at-risk cash award that comprises 50% of LTIP opportunity; based on adjusted EBITDA; no guaranteed minimum payout; maximum payout of 200% of target | |||||||

| 30% | ||||||||

TIME-BASED PAY (At Risk) | ||||||||

| 18% | ||||||||

| Restricted stock units (RSUs) granted under our LTIP | Intended to comprise 50% of LTIP opportunity; vest ratably over four years; no dividends or voting rights with respect to unvested RSUs | |||||||

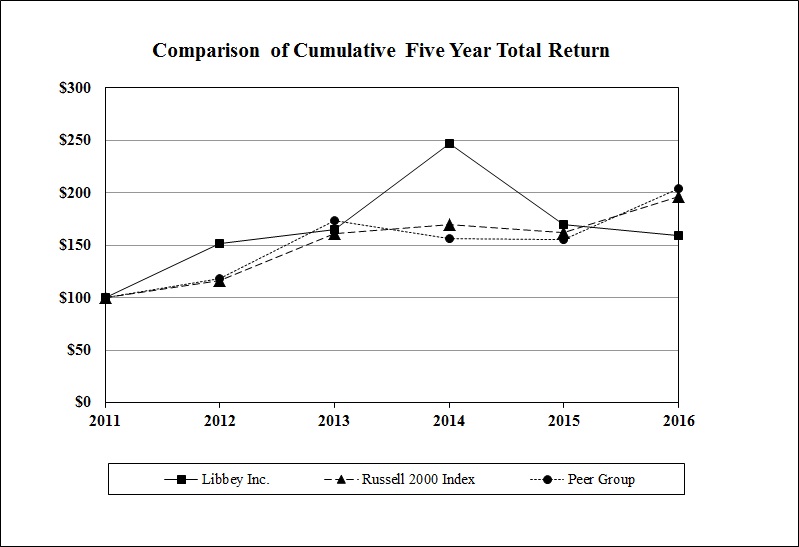

| Company / Index | Base Period Dec 2011 | Indexed Returns Years Ending | ||||

| Dec 2012 | Dec 2013 | Dec 2014 | Dec 2015 | Dec 2016 | ||

| Libbey Inc. | 100 | 151.88 | 164.84 | 246.78 | 169.64 | 158.93 |

| Russell 2000 Index | 100 | 116.35 | 161.52 | 169.43 | 161.95 | 196.45 |

| Peer Group | 100 | 118.33 | 173.49 | 156.65 | 155.96 | 203.80 |

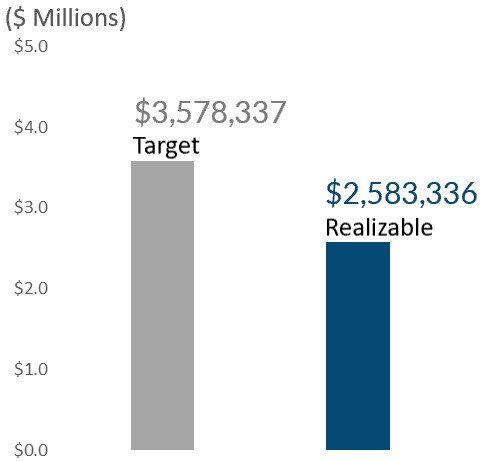

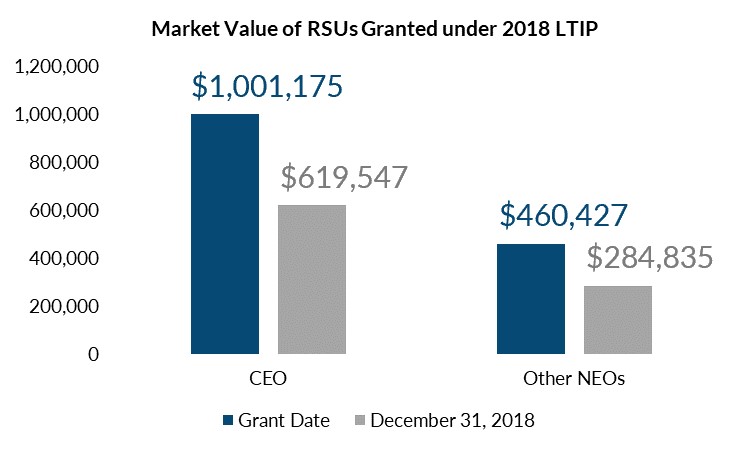

| INCENTIVE PAYMENTS BELOW TARGET | REDUCED LONG-TERM INCENTIVE VALUE | DECLINE IN RSU VALUE | ||||

| Mr. Foley's annualized salary has never been above $825,000, the initial rate established at his time of hire in January 2016 | LTIP payouts were only 19.7% of target; SMIP payouts were 90.3% to 99.4% of target | To conserve shares, the Committee changed the method used to calculate the number of RSUs awarded in 2018, thereby reducing the economic value of RSUs awarded in 2018 by 21% to 26% compared to the |

| RSUs granted in 2018 have declined in value since grant date | ||

| CEO Target Pay Opportunity vs. Realizable Pay | ||

Target Pay includes: • annualized base salary at the rate in effect as of January 1, 2018; • 2018 SMIP target opportunity as estimated at the time of grant; • performance cash target opportunity under the 2016 LTIP (for the 2016-2018 performance cycle); • the grant date fair value of RSUs granted in 2018 pursuant to our 2018 LTIP; and • the value of "All Other Compensation" as reported in the Summary Compensation Table. |  | Realizable Pay includes: • actual base salary; • actual payout under the 2018 SMIP; • actual performance cash payout under the 2016 LTIP (for the 2016-2018 performance cycle); • the market value of RSUs granted in 2018 pursuant to our 2018 LTIP; and • the value of "All Other Compensation" as reported in the Summary Compensation Table. The market value was determined by multiplying the number of RSUs by $3.88, the closing price of our common stock on the last trading day of 2018. |

üWHAT WE DO | ûWHAT WE DON’T DO | |||

ü | We tie pay to performance by ensuring that a significant portion of executive pay is performance-based | |||

| ü | Periodically, we review market data relative to our peer group of companies, and we utilize tally sheets to ensure compensation opportunities are consistent with the Compensation | |||

ü | We mitigate undue risk by emphasizing long-term incentives and using caps on potential payouts under both our annual and long-term incentive plans, clawback provisions in our Omnibus Incentive | |||

ü We have modest post-employment and change in control arrangements that apply to our executives and are competitive with market practices. ü We utilize “double-trigger” vesting of equity awards and non-equity incentives after a change in control. ü We provide only limited perquisites that we believe have a sound benefit to our business. ü We have stock retention requirements to enhance alignment of our executives’ interests with those of our shareholders. ü Our Compensation Committee retains an external, independent compensation consultant and other external advisors as needed. | û We do not maintain compensation programs that we believe create undue risks for our business. û We do not provide significant additional benefits to executive officers that differ from those provided to all other U.S. employees. û We do not permit repricing of stock options or SARs, nor do we permit buyouts of underwater stock options or SARs. ûWe do not permit hedging, pledging or engaging in transactions involving derivatives of our stock. | |||

ûWe do not have employment agreements with our | ||||

ûOur | change in control benefits do not include tax "gross-ups." | |||

| Equity Compensation Plan Information |

| AMENDED AND RESTATED LIBBEY INC. 2016 OMNIBUS INCENTIVE PLAN | |

| Approval of the Amended and Restated Libbey Inc. 2016 Omnibus Incentive Plan. | þ |

The Board of Directors recommends a vote FOR this Proposal. | |

| Audit-Related Matters |

| PROPOSAL NO. 4 | |

| RATIFICATION OF INDEPENDENT AUDITORS | |

| þ | |

| recommends a vote FOR this Proposal | |

| LIBBEY INC. PROXY STATEMENT | ||

PROPOSAL NO. 1 | |

| ELECTION OF DIRECTORS | |

| Election of Ginger M. Jones and Eileen A. Mallesch as Class II Directors. | þ |

The Board recommends a vote FOR each Director Nominee. | |

REQUISITE CHARACTERISTICS FOR BOARD CANDIDATES • the highest professional and personal ethics and values, consistent with long-standing Libbey values and standards • broad experience at the policy-making level in business, government, education, technology or public interest • commitment to enhancing shareholder value • devotion of sufficient time to carry out the duties of Board membership and to provide insight and practical wisdom based upon experience • expertise in areas that add strategic value to the Board - for example, e-commerce experience, consumer products experience; omni-channel experience; brand marketing experience; diversity of race, ethnicity, gender, age, cultural background or professional experience; broad international exposure or specific in-depth knowledge of a key geographic growth area; shared leadership model experience; extensive knowledge of the Company’s business or in a similar type industry or manufacturing environment; mergers and acquisitions; global business integration experience; significant sophisticated financial understanding or experience; global supply chain expertise; transformative change management experience; information technology or enterprise risk management implementation experience; sitting chief executive officer or chief financial officer of a public company; financial acumen; investor relations experience; and risk oversight or management experience • serve on the boards of directors of no more than three other public companies and, if intending to serve on the Audit Committee of the Board, serve on the audit committees of no more than two other public companies |

| GINGER M. JONES | ||

| |||

| |||

| |||

| Class II Age | ||

| Director since 2013 | Independent | Director • Experience as chief financial officer of a public company with over $2 billion in revenues • Significant executive leadership experience in financial strategy and experience in public audit functions, resulting in her qualification as an audit committee financial expert • Experience in global supply chain | ||

Professional Experience Ms. Jones Education Public Company Boards Ms. Jones currently serves on the Board of Directors of Tronox Limited (NYSE: TROX) (since April 2018). | |||||

| EILEEN A. MALLESCH | ||||

| Class II Age Director since 2016 | Independent | Director • Significant financial and enterprise risk management expertise • Public company board and corporate governance experience • Experience with mergers, acquisitions and divestitures • International business experience • Foodservice and consumer products industry knowledge | ||

Professional Ms. Mallesch served as Senior Vice President and Chief Financial Officer of the property and casualty insurance business of Nationwide Insurance from 2005 to 2009. Previously, Ms. Mallesch was employed by General Electric, where she served as Senior Vice President and Chief Financial Officer of Genworth Financial Life Insurance Company from 2003 to 2005; Vice President and Chief Financial Officer of GE Financial Employer Services Group from 2000 to 2003; and Controller for GE Americom from 1998 to 2000. Ms. Mallesch’s positions before 2000 include International Business Area Controller, Energy Ventures for Asea Brown Boveri, Inc., a multinational power and automation technologies company, and financial management positions with PepsiCo, Inc. (NYSE: PEP). Ms. Mallesch is a certified public accountant and began her career as a senior auditor with Arthur Andersen. Education Public Company Ms. Mallesch currently serves on the boards of directors of Brighthouse Financial (NASDAQ: BHF) (since November 2018), Fifth Third Bancorp (NASDAQ:FITB) (since 2016) | |||||

| MICHAEL P. BAUER | ||

Class I Age 54 Chief Executive Officer since 2019 Director since 2019 | Director Qualifications: • Demonstrated ability to turn around and grow businesses under difficult circumstances • Significant financial and leadership skills • Substantial marketing, product development and supply chain experience | ||

Professional Experience Michael P. Bauer joined Libbey as Chief Executive Officer and a director on March 25, 2019. Before joining Libbey, Mr. Bauer spent more than 20 years with Fortune Brands Home & Security, Inc. (NYSE: FBHS), serving most recently as President of The Master Lock Company (the Security segment of Fortune Brands) from December 2014 to September 2018. Mr. Bauer previously held roles of increasing responsibility at Moen Incorporated, another Fortune Brands subsidiary, beginning in 1997 as Corporate Controller and culminating in his roles as Vice President and General Manager, Retail Business, from 2007 to 2011, and President, U.S. Business, from 2011 to 2014. Mr. Bauer’s earlier experience includes serving as Chief Financial Officer and Vice President of Finance for Nook Industries, Inc. (1997), holding various accounting and finance roles at Avery Dennison Corporation (NYSE: AVY) (1992 to 1997), and working as an audit manager for Coopers & Lybrand (1987 to 1992). Education Mr. Bauer holds a bachelor’s degree from Cleveland State University and an M.B.A. from Case Western Reserve University. Public Company Boards None. | |||

| WILLIAM A. FOLEY | ||

Class III Age 71 Executive Chairman since 2019 Chairman since 2011 Director since 1994 | Director Qualifications: • Consumer product marketing experience, particularly in the glass tableware industry • Significant organizational leadership and management skills • Public company board and corporate governance experience | ||

Professional Experience Mr. Foley served as Libbey's Chief Executive Officer from January 2012 until his retirement on March 24, 2019. Following his retirement, Mr. Foley remains an employee and serves as Executive Chairman of the Board. Mr. Foley has been Chairman of the Board since 2011 and a director since 1994. Mr. Foley served as Chairman and Chief Executive Officer of Blonder Accents, LLC from June 2011 until November 2011 and served as Chairman and Chief Executive Officer of Blonder Company from 2008 until June 2011. Previously, Mr. Foley was President and a director of Arhaus, Inc.; co-founder of Learning Dimensions LLC; Chairman and Chief Executive Officer of LESCO Inc.; and Chairman and Chief Executive Officer of Think Well Inc. Mr. Foley also fulfilled the roles of Vice President, General Manager for The Scotts Company Consumer Division, and Vice President and General Manager of Rubbermaid Inc.’s Specialty Products division. Mr. Foley spent the first 14 years of his career with Anchor Hocking Corp. in various positions, including Vice President of Sales & Marketing of the Consumer and Industrial Products Group. Education Mr. Foley holds a bachelor’s degree from Indiana University and an M.B.A. from Ohio University. Public Company Boards Mr. Foley has been a member of the Board of Directors of Myers Industries, Inc. (NYSE: MYE) since 2011. | |||

| DEBORAH G. MILLER | ||||

Age 69 Director since 2003 Independent | • Global management experience • Sales and marketing ingenuity • Extensive information technology experience | ||||

Professional Experience From 2003 to the present, Ms. Miller has been Chief Executive Officer of Enterprise Catalyst Group, a management consulting firm specializing in high technology and biotechnology transformational applications. Ms. Miller was also President, Chief Executive Officer and Chairman of Ascendent Systems, a provider of enterprise voice mobility solutions, from 2005 to 2007. Ms. Miller has more than 30 years of global management experience, including roles as Chief Executive Officer of Maranti Networks; President and Chief Executive Officer of Egenera; Chief Executive Officer of On Demand Software; and various positions with IBM. Throughout her career, Ms. Miller has contributed to the success of international business enterprises with her innovative approach to sales and marketing. Education Ms. Miller has a bachelor’s degree from Wittenberg University, of which she is an Emeritus member of the Board of Directors. Public Company Boards Ms. Miller has been a member of the Board of Directors of Sentinel Group Funds, Inc. (SENCX) since 1995. | |||||

| CAROL B. | ||||

Class I Age Director since 1998 | Independent | Director • Significant financial expertise developed through her experience as a CFA and public company chief financial officer • Public company board and corporate governance experience • Executive leadership and U.S. and international operations experience | |||

Professional Experience Ms. Moerdyk retired from OfficeMax Incorporated (formerly Boise Cascade Office Products Corporation) in 2007. At OfficeMax, she served as Senior Vice President, International from August 2004 until her retirement. Previously, she held various roles at Boise Cascade Office Products Corporation, including Senior Vice President Administration, Senior Vice President North American and Australasian Contract Operations, and Chief Financial Officer. Ms. Moerdyk began her professional career as an assistant professor of finance at the University of Maryland. Education Public Company Boards Ms. Moerdyk has served on the Board of Directors of American Woodmark Corporation (NASDAQ: AMWD) since 2005. | |||||

| STEVE NAVE | ||

Class III Age 49 Nominated in 2017 Independent | Director Qualifications: • Extensive e-commerce experience • Deep knowledge of retail and consumer products industries • Significant executive leadership experience • Brand marketing expertise | ||

Professional Experience Mr. Nave is the retired President and Chief Executive Officer of Bluestem Group Inc., a holding company whose businesses include Bluestem Brands, Inc., a multi-brand, online retailer of a broad selection of name-brand and private label general merchandise through 16 unique retail brands. Mr. Nave served in that position from November 2014, when a subsidiary of Bluestem Group Inc. acquired Bluestem Brands, Inc., until February 2018, when he retired. Mr. Nave continues to serve as a director of Bluestem Group Inc. (since November 2014). From December 2012 until November 2014, Mr. Nave served as President and Chief Executive Officer and a director of Bluestem Brands, Inc. Prior to Bluestem, Mr. Nave held several executive leadership positions with Walmart.com, from its launch in 2000 until 2011, including Chief Financial Officer, Chief Operating Officer, and most recently as its chief executive, as well as serving as a senior officer of Wal-Mart Stores, Inc. From 1995 to 2000 he served in both the Audit and Mergers & Acquisitions practices of Ernst & Young, LLP, serving clients in the Retail & Consumer Products and Technology industries. Mr. Nave previously served on the board of directors of Shopzilla, Inc., a leading source of sales and consumer feedback for online merchants and retail advertisers in the United States and Europe. Education Mr. Nave has a bachelor’s degree in Accounting from Oklahoma State University. Public Company Boards None. | |||

| |||||

Class I Age Director since 2008 | Lead Independent Director since 2016 | Director • Extensive international manufacturing and plant management experience • Extensive organizational leadership experience • Public company board and corporate governance experience | |||

Professional Experience From 2005 until his retirement in December 2015, Mr. Orr served as President, Chief Executive Officer, and a director of Myers Industries, Inc. (NYSE: MYE), an international manufacturer of polymer products for industrial, agricultural, automotive, commercial and consumer markets. Before assuming those positions, Mr. Orr was President and Chief Operating Officer of Myers Industries and General Manager of Buckhorn Inc., a Myers Industries subsidiary. Mr. Orr’s earlier career included 28 years with The Goodyear Tire and Rubber Company, Education Public Company Boards Mr. Orr served on the Board of Myers Industries, Inc. (NYSE: MYE) from May 2005 to December 2015. | |||||

| Audit Committee | Compensation Committee | Nominating and Governance Committee | ||||||||||

| Director | 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||||||

| Carlos V. Duno | Chair | Chair | Member | Member | ||||||||

William A. Foley(1) | ||||||||||||

Ginger Jones(2)(3) | Chair | Chair | Member | Member | ||||||||

Theo Killion(3)(4) | Member | Member | ||||||||||

Eileen A. Mallesch(2)(3) | Member | Member | Member | Member | ||||||||

Deborah G. Miller(3) | Member | Member | Member | Member | ||||||||

| Carol B. Moerdyk | Member | Member | Member | Member | ||||||||

John C. Orr(2)(3) | Member | Member | Chair | Chair | ||||||||

| Board Structure |

| AUDIT COMMITTEE | |

Ginger Jones(1)(2), Chair Eileen A. Mallesch(1)(2) Deborah G. Miller(2) John C. Orr(1)(2) Number of 2018 Meetings: 7 | See “Audit-Related Matters – Report of the Audit Committee” on page 70. |

| COMPENSATION COMMITTEE | |

Carlos V. Duno, Chair(3) Ginger Jones Eileen A. Mallesch Carol B. Moerdyk Steve Nave(3) Number of 2018 Meetings: 6 | • Consider the potential impact of our executive pay program on our risk profile • Review executive pay at comparable companies and recommend to the Board pay levels and incentive compensation plans for our executives • Review and approve goals and objectives relevant to the targets of the executive incentive compensation plans • Establish the CEO’s pay, and in determining the long-term incentive compensation component of the CEO’s pay, consider the Company’s performance, relative shareholder return, the value of similar awards to chief executive officers at comparable companies and the awards given to the CEO in prior years • Annually evaluate the Compensation Committee’s performance and effectiveness • Produce an annual report on executive compensation for inclusion in the proxy statement or annual report on Form 10-K, as required by the SEC • Approve award grants under our equity participation plans and oversee and administer these plans |

| NOMINATING AND GOVERNANCE COMMITTEE | |

John C. Orr, Chair Carlos V. Duno(3) Deborah G. Miller Carol B. Moerdyk Number of 2018 Meetings: 5 | • Develop and implement corporate governance policies and practices • Establish a selection process for new directors to meet the needs of the Board, evaluate and recommend candidates for Board membership, assess the Board's performance and review that assessment with the Board and establish objective criteria to evaluate the CEO's performance • Review director pay and recommend to the Board pay levels for our non-management directors • Review plans for both emergency and orderly succession of the CEO |

| (1) | Determined by the Board to be qualified as an audit committee financial expert, as defined in SEC regulations. |

| (2) | Determined by the Board to be financially sophisticated and literate and to have accounting and related financial management expertise, as those qualifications are interpreted by the Board in its business judgment. |

| (3) | Effective May 14, 2019, Mr. Nave will replace Mr. Duno as Chair of the Compensation Committee and as a member of the Nominating and Governance Committee. Mr. Duno will retire from the Board effective immediately preceding the Annual Meeting on May 15, 2019. |

| Board Processes |

| Non-Management Directors' Compensation |

| ELEMENT OF COMPENSATION | ANNUAL COMPENSATION AMOUNT | |

| Annual Cash Retainer | $47,500 (increased to $62,000 effective January 1, 2019) | |

| Lead Independent Director Cash Retainer | $20,000 | |

| Equity Award | On the date of each annual meeting of shareholders, outright grant of shares of common stock valued at $80,000 on the date of grant, attributable to service during the preceding year (increased to $90,000 beginning with the grant on the date of the 2019 Annual Meeting) Our stock retention guidelines require that the director hold the net after-tax shares issued for at least one year from the date of grant | |

Committee Chair Cash Retainers (in addition to Committee Member Cash Retainers) | $12,500 (Audit Committee and Compensation Committee) $6,500 (Nominating and Governance Committee) | |

| Committee Member Cash Retainers | $7,500 (Audit Committee and Compensation Committee) $5,000 (Nominating and Governance Committee) | |

| Other Fees | $500 per one-half day of service | |

| Director Compensation for Year Ended December 31, 2018 | |||||||||||

| Director | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(3) | All Other Compensation ($) | Total ($) | ||||||

| Carlos V. Duno | 73,708 | 79,998 | 0 | 0 | 153,706 | ||||||

| Ginger M. Jones | 76,208 | 79,998 | 0 | 0 | 156,206 | ||||||

| Eileen A. Mallesch | 63,708 | 79,998 | 0 | 0 | 143,706 | ||||||

| Deborah G. Miller | 61,208 | 79,998 | 0 | 0 | 141,206 | ||||||

| Carol B. Moerdyk | 61,208 | 79,998 | 0 | 0 | 141,206 | ||||||

| Steve Nave | 56,208 | 79,998 | 0 | 0 | 136,206 | ||||||

| John C. Orr | 97,208 | 79,998 | 0 | 0 | 177,206 | ||||||

| (1) | Includes pay deferred into the Libbey common stock measurement fund pursuant to the Director DCP. |

| (2) | Represents the grant date fair value, determined in accordance with FASB ASC Topic 718, of awards of stock made to non-management directors on May 16, 2018. On that date, we awarded certain non-management directors stock having a grant date fair value of $6.70 per share. The awards were attributable to service during the preceding year. Pursuant to our stock ownership and retention guidelines for non-management directors, directors are required to hold the net after-tax shares issued for at least one year from the grant date. |

| (3) | We do not maintain a pension plan for our non-management directors. We do not guarantee any particular rate of return on any pay deferred pursuant to our deferred compensation plans. Dividends on pay deferred into the Libbey Inc. phantom stock or measurement fund under our deferred compensation plans for non-management directors accrue only if and to the extent payable to holders of our common stock. Pay deferred into interest-bearing accounts under our deferred compensation plans for non-management directors does not earn an above-market return, as the applicable interest rate is the yield on ten-year treasuries. Pay deferred into other measurement funds under our deferred compensation plans for non-management directors does not earn an above-market return, as that pay earns a return only if and to the extent that the net asset value of the measurement fund into which the pay is deemed invested actually increases. |

MICHAEL P. BAUER - CHIEF EXECUTIVE OFFICER | |

| Biographical information for Mr. Bauer appears on page 13. | |

JAMES C. BURMEISTER - SENIOR VICE PRESIDENT, CHIEF FINANCIAL OFFICER | |

| Mr. Burmeister, 51, has been Senior Vice President, Chief Financial Officer since June 2018. Mr. Burmeister joined Libbey as Vice President, Chief Financial Officer on March 30, 2017. Mr. Burmeister came to Libbey from The Andersons, Inc. (NASDAQ: ANDE), where he served since 2014 as Vice President, Finance and Treasurer, managing the treasury, tax, investor relations, sourcing, business development and continuous improvement functions. Before joining The Andersons, Inc., Mr. Burmeister held roles of increasing responsibility in operations finance with Owens Corning (NYSE: OC), beginning in 2005 as Director of Finance of the cultured stone business and culminating in his role from 2013-2014 as Vice President, Finance of the roofing and asphalt division. Earlier in his career, Mr. Burmeister served in a variety of roles with General Electric (NYSE: GE), including an assignment with GE's highly regarded Corporate Audit Staff, and with Rubbermaid in its supply chain function. Mr. Burmeister is a graduate of the U.S. Naval Academy and served as a commissioned officer in the U.S. Marine Corps from 1990 to 1995. | |

JAMES (KLAY) K. HUDDLESTON - SENIOR VICE PRESIDENT, CHIEF DIGITAL OFFICER | |

| Mr. Huddleston, 48, has been Senior Vice President, Chief Digital Officer since June 2018, having joined Libbey as Vice President, Chief Digital Officer on November 13, 2017. From 2008 until joining Libbey, Mr. Huddleston served as Senior Vice President, Omni-Commerce for Resource/Ammirati, an IBM (NYSE: IBM) consulting agency specializing in brand, commerce, and technology solutions to drive sales and increase customer engagement. Mr. Huddleston previously served as Vice President & General Manager, Direct for Tween Brands from 2006 to 2008 and Director, E-Commerce for Lane Bryant from 2005 to 2006. Mr. Huddleston's earlier career included various marketing and product management positions for Amazon.com, Inc. (NASDAQ: AMZN) from 1998 to 2004. | |

SUSAN A. KOVACH - SENIOR VICE PRESIDENT, GENERAL COUNSEL AND SECRETARY | |

| Ms. Kovach, 59, has been Senior Vice President, General Counsel and Secretary of Libbey Inc. since June 2018. Ms. Kovach was Vice President, General Counsel and Secretary of Libbey Inc. from July 2004 until June 2018, having joined Libbey in December 2003 as Vice President, Associate General Counsel and Assistant Secretary. Ms. Kovach was Of Counsel to Dykema Gossett PLLC from 2001 through November 2003. She served from 1997 to 2001 as Vice President, General Counsel and Corporate Secretary of Omega Healthcare Investors, Inc. (NYSE: OHI) and from 1998 to 2000 as Vice President, General Counsel and Corporate Secretary of Omega Worldwide, Inc., a NASDAQ-listed firm. Prior to joining Omega Healthcare Investors, Inc., Ms. Kovach was a partner in Dykema Gossett PLLC from 1995 through November 1997 and an associate in Dykema Gossett PLLC from 1985 to 1995. | |

WILLIAM C. MOSSING - SENIOR VICE PRESIDENT, CHIEF SUPPLY CHAIN OFFICER | |

| Mr. Mossing, 52, has been Senior Vice President, Chief Supply Chain Officer since June 2018, having joined Libbey as Vice President, Chief Supply Chain Officer on December 1, 2017. Mr. Mossing came to Libbey from Bendix Commercial Vehicle Systems LLC, where he served as Vice President, Supply Chain since 2011 and Vice President and General Manager - Modules from 2008 to 2011. Mr. Mossing previously served as Product Line Director from 2006 to 2008 and Assistant General Manager from 2004 to 2008 of Bendix Spicer Foundation Brake LLC, a joint venture of Bendix Commercial Vehicle Systems LLC and Dana Corporation. Mr. Mossing's previous experience includes various positions of increasing responsibility in the manufacturing, supply chain, and engineering functions at Dana Corporation, a predecessor to Dana Incorporated (NYSE: DAN). | |

SARAH J. ZIBBEL - SENIOR VICE PRESIDENT, CHIEF HUMAN RESOURCES OFFICER | |

| Ms. Zibbel, 39, has been Senior Vice President, Chief Human Resources Officer since June 2018, having joined Libbey in April 2018 as Vice President, Chief Human Resources Officer. Ms. Zibbel came to Libbey from Owens-Illinois, Inc. (NYSE: OI), where she most recently served as Vice President, Global Talent, Culture & Organizational Effectiveness since December 2017. Ms. Zibbel's previous positions at Owens-Illinois include Vice President, HR Strategy & Enterprise Transformation from 2016 to December 2017, Vice President, Human Resources, Global Technology and Operations from 2015 to 2016, Director, Corporate Human Resources from 2011 to 2015, and Manager, Corporate Human Resources from 2010 to 2011. Before joining Owens-Illinois, Ms. Zibbel was HR Operations Manager for Rexam PLC from 2009 to 2010, Human Resources Leader at Owens Corning (NYSE: OC) from 2005 to 2009, and Human Resource Director at MedCorp Inc. from 2002 to 2005. | |

| PROPOSAL NO. 2 | |

| ADVISORY SAY-ON-PAY | |

We are providing shareholders the opportunity to cast an advisory vote with respect to the following resolution: | þ |

The Board recommends a vote FOR this Proposal | |

| Support our business strategy; drive long-term performance and shareholder value | • | Annual and long-term incentive plan performance measures focused on growing our business profitably, improving our ability to generate cash, and improving our | |

| adjusted EBITDA • | |||

| Align interests of executives and shareholders | • | Performance-based annual and long-term incentive plans | |

• | 80% of our | ||

| “at-risk” • | |||

| RSUs directly align interests of executives and shareholders | |||

• | Stock | ||

| Attract and retain highly talented and experienced senior executives who are key to implementing our strategy and achieving future success | • | ||

| Align executive pay program with corporate governance best practices | • | Limited perquisites (tax return preparation and financial planning, executive health screening program, limited ground transportation and airline club membership) | |

• | Limited severance pay arrangements | ||

• | |||

| Stock | |||

• | Annual and long-term incentive awards and RSU | ||

| Named Executive | Title | |

William A. Foley | Executive Chairman and | |

| former Chief Executive Officer | ||

| Susan A. Kovach | Senior Vice President, General Counsel and Secretary | |

| Salvador Miñarro Villalobos | Vice President, General Manager, U.S. and Canada until his employment ended on January 15, 2018 | |

| Sarah J. Zibbel | Senior Vice President, Chief Human Resources Officer | |

PROFITABLE GROWTH | OPERATIONAL EXCELLENCE | ORGANIZATIONAL EXCELLENCE | ||

| Improving marketing capabilities in new product development and innovation to drive profitable growth | Improving operating processes, systems and technology | Building winning teams that foster high performance and live our core values | ||

| NO CEO SALARY INCREASE | INCENTIVE PAYMENTS BELOW TARGET | REDUCED LONG-TERM INCENTIVE VALUE | DECLINE IN RSU VALUE | |||

| Mr. Foley's annualized salary has never been above $825,000, the initial rate established at his time of hire in January 2016 | LTIP payouts were only 19.7% of target; SMIP payouts were 90.3% to 99.4% of target(1) | To conserve shares, the Committee changed the method used to calculate the number of RSUs awarded in 2018, thereby reducing the economic value of RSUs awarded in 2018 by 21% to 26% compared to the previous method | RSUs granted in 2018 have declined in value since grant date | |||

| • | Mr. Bauer does not have an employment agreement. Mr. Bauer is a party to a change in control agreement with the Company and is eligible to participate in the Company's Executive Severance Compensation Policy. Additional information regarding Mr. Bauer's change in control and severance benefits can be found under"Potential Payments upon Termination or Change in Control" on page 40. |

|  | |

| Type of Pay | Element | Key Characteristics | Objectives | |||

| Base salary | Base salary | Fixed component; reviewed annually | ||||

| Incentive-Based Pay | Annual cash incentive award under our | At-risk variable pay opportunity for short-term performance; no guaranteed minimum payout; maximum payout equal to | ||||

| Long-term performance cash incentive awards under our | Formula-driven, at-risk cash award that comprises | |||||

| Time-Based Pay | ||||||

| RSUs granted under our | ||||||

| Element | Key Characteristics | Objectives | ||

| Perquisites | Direct payment or reimbursement of personal financial planning and tax return preparation fees; annual executive health screening and related services; ground transportation for trips between Toledo, Ohio, and the Detroit/Wayne County Metropolitan airport for the executive when traveling for business purposes and the executive's spouse when traveling together; membership in one airline club of the executive's choice; for executives relocating at Libbey's request, moving and related expenses associated with the move (may also include loss-on-sale protection when necessary to attract talent); and, for Mr. Foley until April 24, 2019, a housing allowance for housing in the Toledo, Ohio, area since his primary residence is in the Cleveland, Ohio, area | Attract and retain talent | ||

| Welfare and retirement benefits | Medical, dental and life insurance benefits for U.S. executives on the same basis as for all U.S. salaried employees; matching contributions to our 401(k) savings plan on the same basis as for all U.S. salaried employees; for Ms. Kovach only, retirement benefits under our Salary Plan (a qualified retirement plan for all U.S. salaried employees hired before January 1, 2006) and our Supplemental Retirement Benefit Plan ("SERP") (an excess, non-qualified plan designed to provide substantially identical retirement benefits as the Salary Plan to the extent the Salary Plan cannot provide those benefits due to IRS limitations; no enhanced credit has ever been provided). Company contribution credits under the Salary Plan and the SERP were discontinued at the end of 2012 | Attract and retain talent | ||

| Limited Income Protection | Separation benefits under change in control agreements or our executive severance policy; contingent component payable only if employment is terminated under specified circumstances | Attract and retain talent | ||

| SALARY HIGHLIGHTS | • No salary increase for CEO • No salary increases for recently hired executives • 3% - 4% salary increases for certain other named executives |

| Named Executive | Annualized Base Salary ($) | ||

| W. Foley | 825,000 | ||

| J. Burmeister | 390,000 | ||

| S. Kovach | 364,154 | ||

| S. Miñarro | 362,397 | ||

| W. Mossing | 300,000 | ||

| S. Zibbel | 310,002 | ||

• Annual Cash Incentive Award • Based 40% on Company's adjusted cash earnings, 15% on e-commerce revenue, 10% on new product revenue, and 35% on performance against strategic objectives • Named executives (excluding Mr. Miñarro) received below-target payouts ranging from 90.3% to 99.4% | |

| Named Executive | Target Award as a Percent of Full-Year Base Salary | Target Award based on Actual Full-Year Base Salary ($) | |||

| W. Foley | 100% | 825,000 | |||

| J. Burmeister | 60% | 231,750 | |||

| S. Kovach | 50% | 180,752 | |||

| W. Mossing | 50% | 150,000 | |||

| S. Zibbel | 50% | 114,313 | |||

| Adjusted Cash Earnings | ||||||||

Full-Year Adjusted Cash Earnings (dollars in thousands) | Percent of Targeted Cash Earnings | Performance Level | Payout Percentage | |||||

| $103,557 | 110.0% | Maximum | 200% | |||||

| $94,143 | 100.0% | Target | 100% | |||||

| $75,314 | 80.0% | Threshold | 50% | |||||

| < $75,314 | < 80.0% | Below Threshold | 0% | |||||

| Item | Amount of Adjustment to Company-Wide Cash Earnings ($) | ||

| Costs Related to Strategic Initiative | 2,341,000 | ||

| Total | 2,341,000 | ||

| E-Commerce Revenue | ||||||

| Full-Year E-Commerce Revenue (represented as % increase vs. prior year) | Percent of Targeted E-Commerce Revenue | Performance Level | Payout Percentage | |||

| 67% | 125% | Maximum | 200% | |||

| 33% | 100% | Target | 100% | |||

| 20% | 90% | Threshold | 50% | |||

| < 20% | < 90% | Below Threshold | 0% | |||

| New Product Gross Revenue | ||||||||

Full-Year New Product Gross Revenue (dollars in thousands) | Percent of Targeted New Product Gross Revenue | Performance Level | Payout Percentage | |||||

| $59,840 | 110.0% | Maximum | 200% | |||||

| $54,000 | 100.0% | Target | 100% | |||||

| $48,960 | 90.0% | Threshold | 50% | |||||

| < $48,960 | < 90.0% | Below Threshold | 0% | |||||

| ERP Planning and Implementation | |||||||

| Strategy Link: | Supports operational excellence and profitable growth | Threshold | Target | Maximum | Actual Performance | ||

| ERP investment is critical to driving future top-line growth and margin improvement. We anticipate that, once fully implemented, our ERP will help us achieve annual run-rate benefits of $15 - $20 million. | Execute one milestone, within budget | Execute two milestones, within budget | Execute three milestones, within budget | Executed one milestone, within budget | |||

| Measure: | Qualitative | (3 rating) | (4 rating) | (5 rating) | 3 rating | ||

| Service Levels | |||||||

| Strategy Link: | Supports profitable growth | Threshold | Target | Maximum | Actual Performance | ||

| Providing exceptional service differentiates us from our competitors. We believe superior service will help us accelerate our growth, gain stronger product placement, and enhance margins in the long term. | 83% | 86% | 90% | 90% | |||

| Measure: | Percent of customer orders filled on time and in full | (2 rating) | (3 rating) | (5 rating) | 5 rating | ||

| Individual and Leader Development | |||||||

| Strategy Link: | Supports organizational excellence | Threshold | Target | Maximum | Actual Performance | ||

| To ensure our success, our people must be strong and effective leaders who embody the right skill sets and capabilities to execute our strategy. By developing our leaders, we are preparing for continued growth as an organization, building our succession plans, and embracing a new and ever-changing workforce. | Assess 50% of leaders; train supervisors at manufacturing sites; complete development plans for 75% of salaried employees | Assess 75% of leaders; train supervisors at manufacturing sites + a non-manufacturing site; development plans for > 75% of salaried employees | Assess all leaders; train supervisors at all locations; complete development plans for all salaried employees | Assessed all leaders; trained all supervisors; completed development plans for all salaried employees | |||

| Measure: | Qualitative | (3 rating) | (4 rating) | (5 rating) | 5 rating | ||

| Strategic Objectives | ||

| Overall Rating | Payout Percentage | |

| above 4.5 | 176% - 200% | |

| 4.1 - 4.5 | 151% - 175% | |

| 3.6 - 4.0 | 126% - 150% | |

| 3.1 - 3.5 | 101% - 125% | |

| 2.6 - 3.0 | 76% - 100% | |

| 2.0 - 2.5 | 51% - 75% | |

| below 2.0 | 0% - 50% | |

| Component | Payout Score | Weight | Weighted Payout Score | Total Unadjusted Payout Score | ||||

| Adjusted Cash Earnings | 0% | 40% | 0.0% | 90.3% | ||||

| E-Commerce Revenue | 100% | 15% | 15.0% | |||||

| New Product Revenue | 170% | 10% | 17.0% | |||||

| Strategic Objectives | 166.7% | 35% | 58.3% | |||||

| Target Award | Actual Payout | ||||||||

| Named Executive | As Percent of Full-Year Base Salary | Based on Actual Full-Year Base Salary ($) | As Percent of Target | Actual Award ($) | |||||

| W. Foley | 100% | 825,000 | 99.4% | 819,775 | |||||

| J. Burmeister | 60% | 231,750 | 99.4% | 230,282 | |||||

| S. Kovach | 50% | 180,752 | 99.4% | 179,607 | |||||

| W. Mossing | 50% | 150,000 | 90.3% | 135,500 | |||||

| S. Zibbel | 50% | 114,313 | 90.3% | 103,263 | |||||

| LTIP HIGHLIGHTS | • Long-term performance cash incentive award • Based on Company's adjusted ROIC for 2016 and 2017 and adjusted EBITDA for 2018 • Below target payout of 19.7% for 2016 LTIP (for the 2016-2018 performance cycle) • 2017 LTIP (for 2017-2019 performance cycle) and 2018 LTIP (for 2018-2020 performance cycle) both tracking below target |

| Named Executive | 2018 Target Long-Term Award as a Percentage of Annualized Base Salary | |

| W. Foley | 300% | |

| J. Burmeister | 100% | |

| S. Kovach | 95% | |

| W. Mossing | 70% | |

| S. Zibbel | 70% | |

| ◦ | For any performance cycle of which 2016 is a part, our 2016 adjusted ROIC target was 10.8%. We achieved adjusted ROIC of 9.9% in 2016, resulting in a payout score for the 2016 calendar year of 59%, as determined according to the following scale: |

| Basis Points Above or Below 2016 Targeted Adjusted ROIC | Payout Score | |

| +100 | 200% | |

| 0 | 100% | |

| -150 | 25% | |

| Less than -150 | 0% | |

| ◦ | For any performance cycle of which 2017 is a part, our 2017 adjusted ROIC target was 9.2%. We achieved 2017 adjusted ROIC of 3.1%, resulting in a payout score for the 2017 calendar year of 0%, as determined according to the following scale: |

| Basis Points Above or Below 2017 Targeted Adjusted ROIC | Payout Score | |

| +50 | 200% | |

| 0 | 100% | |

| -100 | 50% | |

| Less than -100 | 0% | |

| ◦ | For any performance cycle of which 2018 is a part, our 2018 adjusted EBITDA target was $89.8 million. In setting the target, the Committee considered the Company's prior year performance and alignment with the Company's annual operating plan and long-term strategic initiatives. The volatile global economy, decline in restaurant traffic, shift in retail sales toward e-commerce, and competitive pricing environment of 2017 were expected to continue in 2018. The realities of the business environment led the Company to shift its priorities from aggressive growth toward improving marketing and new product development capabilities and innovation, improving customer relationships, and simplifying the business - all of which would support future, sustainable, profitable growth. The Committee believed that an adjusted EBITDA target of $89.8 million would prove sufficiently challenging to achieve. In February 2019, the Committee determined that we had achieved 2018 adjusted EBITDA of $72.5 million, resulting in a payout score for the 2018 calendar year of 0%, as determined according to the following scale: |

| Percent of 2018 Targeted Adjusted EBITDA | Payout Score | |

| 112.5% | 200% | |

| 0 | 100% | |

| 87.5% | 50% | |

| Less than 87.5% | 0% | |

| Payout Score | ||

| 2016 calendar year | 59% | |

| 2017 calendar year | 0% | |

| 2018 calendar year | 0% | |

| Overall Payout Score | 19.7% | |

| Named Executive | 2016 LTIP Cash Target ($) | 2016 LTIP Cash Payout ($) | 2016 LTIP Cash Payout as a Percentage of Target | |||

| W. Foley | 990,000 | 195,030 | 19.7% | |||

J. Burmeister(1) | 87,900 | 17,316 | 19.7% | |||

| S. Kovach | 127,878 | 25,192 | 19.7% | |||

S. Miñarro(1) | 114,421 | 22,541 | 19.7% | |||

W. Mossing(1) | 30,324 | 5,974 | 19.7% | |||

S. Zibbel(1) | 21,700 | 4,275 | 19.7% | |||

| (1) | Prorated to reflect the portion of the performance cycle during which the named executive was employed. |

| EQUITY HIGHLIGHTS | • Annual awards under LTIP • Economic value of RSUs at time of award intended to equal 50% of LTIP target opportunity • 4-year ratable vesting |

Annualized Salary Before Increase | Annualized Salary After Increase | |||

| Named Executive | ($) | ($) | ||

| S. Buck | 475,000 | 484,500 | ||

| A. Cerioli | 400,002 | 408,002 | ||

| S. Kovach | 336,520 | 343,250 | ||

| S. Miñarro | 350,040 | 357,041 | ||

| Revenue Growth (Net Sales) | Adjusted Cash Earnings | |||||||

Full Year Net Sales (dollars in thousands) | Percent of Targeted Net Sales | Performance Level | Payout Percentage | Full Year Cash Earnings (dollars in thousands) | Percent of Targeted Cash Earnings | Performance Level | Payout Percentage | |

| $880,000 | 104.9% | Maximum | 200% | $131,076 | 110.0% | Maximum | 200% | |

| $839,138 | 100.0% | Target | 100% | $119,160 | 100.0% | Target | 100% | |

| $800,000 | 95.3% | Threshold | 40% | $95,328 | 80.0% | Threshold | 50% | |

| < $800,000 | < 95.3% | Below Threshold | 0% | < $95,328 | < 80.0% | Below Threshold | 0% | |

| Item | Amount of Adjustment to Company-Wide Cash Earnings | |||

| Expense in connection with executive terminations | $ | 3,554,000 | ||

| Income related to natural gas contract hedge ineffectiveness | (1,860,000 | ) | ||

| 2010 Mexican tax assessment | 1,085,000 | |||

| Total | $ | 2,779,000 | ||

| Preliminary Financial Performance Payout Score as % of Target | ||||

| Revenue Growth | Adjusted Cash Earnings | Total | ||

| 47.5 | 99.0 | 73.25 | ||

| Final Financial Performance Payout Score as % of Target | ||||

| Revenue Growth | Adjusted Cash Earnings | Total | ||

| 40.0 | 99.0 | 69.5 | ||

| Named Executive | 2016 Target Long-Term Award as a Percentage of Annualized Base Salary (%) | 2016 LTIP Performance Cash Target as Percentage of Annualized Base Salary (%) | ||

| W. Foley | 300 | 120 | ||

| S. Streeter | 300 | 120 | ||

| S. Buck | 140 | 56 | ||

| A. Cerioli | 120 | 48 | ||

| S. Kovach | 95 | 38 | ||

| S. Miñarro | 120 | 48 | ||

| J. White | 150 | 60 | ||

| Basis Points Above or Below 2015 Targeted ROIC | Payout Score (%) | |||

| +50 | 200 | |||

| 0 | 100 | |||

| -70 | 50 | |||

Less than -70 | 0 | |||

| Basis Points Above or Below 2016 Targeted ROIC | Payout Score (%) | |||

| +100 | 200 | |||

| 0 | 100 | |||

| -150 | 25 | |||

Less than -150 | 0 | |||

| Item | Amount of Adjustment to Company-Wide EBITDA | |||

| Product portfolio optimization | $ | 5,693,000 | ||

| Income related to natural gas contract hedge ineffectiveness | (1,860,000 | ) | ||

| Toledo Plant work stoppage | 4,162,000 | |||

| Executive terminations | 4,460,000 | |||

| Pension settlements | 168,000 | |||

| Total | $ | 12,623,000 | ||

| Adjusted EBITDA Margin | Net Debt to Adjusted EBITDA Ratio | |||||

Percent of Targeted Adjusted EBITDA Margin | Performance Level | Payout Percentage | Percent of Targeted Net Debt to Adjusted EBITDA Ratio | Performance Level | Payout Percentage | |

| 115% | Maximum | 200 | 115% | Maximum | 200 | |

| 100% | Target | 100 | 100% | Target | 100 | |

| 80% | Threshold | 50 | 80% | Threshold | 50 | |

| <80% | Below Threshold | 0 | <80% | Below Threshold | 0 | |

| Final Payout Score as % of Target | ||||

| Adjusted EBITDA Margin | Net Debt to Adjusted EBITDA Ratio | Total | ||

| 80.6% | 68.2% | 74.4% | ||

| Death or Disability | Resignation or Retirement | Termination without Cause | Termination without Cause in connection with Change in Control | |||||

| Cash Severance | None | None | None | None | ||||

Annual Cash Incentive (SMIP)(1) | Prorated and subject to actual performance | Prorated and subject to actual performance | Prorated and subject to actual performance | Prorated and subject to actual performance | ||||

Long-Term Performance Cash Incentive(1) | Prorated target award for any current performance cycle, paid as soon as administratively feasible | Prorated and subject to actual performance | Prorated and subject to actual performance | Not prorated but subject to actual performance | ||||

| Equity Awards Granted in 2016 | All awards immediately vest | All awards immediately vest | All awards immediately vest | All awards immediately vest | ||||

| Equity Awards Granted in 2017 and 2018 | All awards immediately vest | Forfeit all unvested awards | Awards scheduled to vest within one year of termination date will immediately vest | All awards immediately vest | ||||

| Health, Welfare and Other Benefits | Accrued Benefits only | Accrued Benefits only | Accrued Benefits only | Accrued Benefits only | ||||

| (1) | Except in the case of death or permanent disability, amounts paid under our SMIP and the performance cash component of our LTIP will be paid between January 1 and March 15 of the year following the end of the relevant performance cycle. |

| Death or Disability | Termination for Cause or Quit without Good Reason | Quit for Good Reason | Termination without Cause | Termination without Cause or Quit for Good Reason in connection with Change in Control | |||||||

| All Non-CEO NEOs | All Non-CEO NEOs | ||||||||||

Non-CEO NEOs | Mr. Mossing and Ms. Zibbel(1) | Non-CEO NEOs | All Non-CEO NEOs | ||||||||

| Cash Severance | None | ||||||||||

| None | None | Lump sum 2x annual salary + 2x target annual incentive(3) | |||||||||

| Annual Cash Incentive (SMIP) | None | None | None | Prorated and subject to actual performance(2) | |||||||

| Long-Term Performance Cash Incentive | |||||||||||

| Prorated target award for any current performance cycle | None | Prorated and | |||||||||

| subject to actual performance(2) | Prorated and subject to actual performance(2) | Not prorated but subject to actual performance(2) | |||||||||

| Equity Awards | |||||||||||

| Forfeit all unvested awards | Forfeit all unvested awards | Awards scheduled to vest within 1 year immediately vest | All awards immediately vest | ||||||||

| Health, Welfare and Other Benefits | Benefits only | Accrued Benefits only | Accrued Benefits only | Accrued Benefits; continued dental/health benefits during period of salary continuation; outplacement services during period of salary continuation | Accrued Benefits; 18 months continued dental/health/life insurance benefits; outplacement services with cost to Libbey ≤15% base salary; financial planning services with cost to Libbey ≤$10,000 | ||||||

| Conditions to Payment of Benefits | |||||||||||

| None | None | None | |||||||||

| Release of claims against | |||||||||||

| Libbey; Confidentiality | |||||||||||

| obligations; Obligation to assign intellectual property | |||||||||||

| rights; Obligation to assist with | |||||||||||

| Release of claims against | |||||||||||

| Libbey; Confidentiality | |||||||||||

| obligations; Obligation to assign intellectual property | |||||||||||

| rights; Obligation to assist with | |||||||||||

| (1) | The above table assumes a termination date of December 31, 2018. Mr. Mossing and Ms. Zibbel have since become eligible for the same termination benefits as the other non-CEO named executives. |

| (2) | Amounts paid under our SMIP and the performance cash component of our LTIP will be paid between January 1 and March 15 of the year following the end of the relevant performance cycle. |

| Lump-sum cash payments will be paid no later than five days after termination |

Carlos V. Duno, Chair | |

Ginger M. Jones | |

Eileen A. Mallesch | |

Carol B. Moerdyk Steve Nave |

| Executive Compensation Tables |

Name and Principal Position | Year | Salary ($)(1) | Bonus ($)(2) | Stock Awards ($)(3) | Option Awards ($)(4) | Non-Equity Incentive Compensation ($)(5) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(6) | All Other Compensation ($)(7) | Total ($) | |||||||||||||||||

| William A. Foley | 2016 | 804,185 | 0 | 1,037,687 | 532,688 | 801,520 | 0 | 110,050 | 3,286,130 | |||||||||||||||||

| Chairman and Chief | ||||||||||||||||||||||||||

Executive Officer(8) | ||||||||||||||||||||||||||

| Stephanie A. Streeter | 2016 | 21,166 | 0 | 0 | 0 | 653,666 | 0 | 3,301,516 | 3,976,348 | |||||||||||||||||

| Chief Executive | 2015 | 792,438 | 0 | 960,406 | 517,050 | 728,386 | 0 | 73,677 | 3,071,957 | |||||||||||||||||

Officer(9) | 2014 | 768,750 | 0 | 4,436,131 | 413,043 | 941,390 | 0 | 44,259 | 6,603,573 | |||||||||||||||||

| Sherry Buck | 2016 | 482,125 | 0 | 257,312 | 143,125 | 386,211 | 0 | 47,115 | 1,315,888 | |||||||||||||||||

| Vice President, Chief | 2015 | 462,500 | 0 | 245,784 | 132,320 | 221,129 | 0 | 41,651 | 1,103,384 | |||||||||||||||||

Financial Officer(10) | 2014 | 386,907 | 0 | 217,148 | 112,263 | 311,530 | 0 | 35,988 | 1,063,836 | |||||||||||||||||

| Annunciata Cerioli | 2016 | 424,670 | 0 | 185,728 | 103,312 | 214,012 | 0 | 60,679 | 988,401 | |||||||||||||||||

| Vice President, Chief | 2015 | 377,646 | 0 | 244,588 | 77,851 | 86,713 | 0 | 27,435 | 814,233 | |||||||||||||||||

| Supply Chain | 2014 | 29,170 | 252,289 | 246,591 | 70,866 | 13,714 | 0 | 0 | 612,630 | |||||||||||||||||

Officer(11) | ||||||||||||||||||||||||||

| Susan A. Kovach | 2016 | 341,568 | 0 | 123,696 | 68,809 | 209,254 | 21,812 | 34,191 | 799,330 | |||||||||||||||||

| Vice President, | 2015 | 334,070 | 0 | 128,214 | 69,025 | 123,403 | 0 | 24,320 | 679,032 | |||||||||||||||||

| General Counsel & | 2014 | 325,117 | 25,000 | 129,672 | 67,034 | 189,097 | 29,532 | 19,442 | 784,894 | |||||||||||||||||

| Secretary | ||||||||||||||||||||||||||

| Salvador Miñarro | 2016 | 355,291 | 0 | 162,528 | 90,407 | 241,106 | 0 | 98,845 | 948,177 | |||||||||||||||||

| Villalobos | 2015 | 373,902 | 0 | 617,047 | 93,409 | 143,209 | 0 | 71,138 | 1,298,705 | |||||||||||||||||

| Vice President, | ||||||||||||||||||||||||||

| General Manager | ||||||||||||||||||||||||||

U.S. & Canada(12) | ||||||||||||||||||||||||||

| James H. White | 2016 | 131,250 | 0 | 304,720 | 169,491 | 127,004 | 0 | 1,041,734 | 1,774,199 | |||||||||||||||||

| Vice President, Chief | 2015 | 246,591 | 0 | 1,561,933 | 148,879 | 80,949 | 0 | 13,980 | 2,052,332 | |||||||||||||||||

Operating Officer(13) | ||||||||||||||||||||||||||

| Summary Compensation Table |

| Change in Pension Value and Nonqualified Deferred Compensation Earnings | ||||||||||||||||||||||||||

| Non-Equity Incentive Compensation | ||||||||||||||||||||||||||

| Salary | Bonus | Stock Awards | Option Awards | All Other Compensation | Total | |||||||||||||||||||||

| Name and Principal Position | Year | ($) | ($)(1) | ($)(2) | ($)(3) | ($)(4) | ($)(5) | ($)(6) | ($) | |||||||||||||||||

| William A. Foley | 2018 | 825,000 | 0 | 814,353 | 0 | 1,014,805 | 0 | 123,984 | 2,778,142 | |||||||||||||||||

Chairman and Chief Executive Officer(7) | 2017 | 770,000 | 0 | 544,611 | 322,592 | 707,520 | 0 | 120,649 | 2,465,372 | |||||||||||||||||

| 2016 | 804,185 | 0 | 1,037,687 | 532,688 | 801,520 | 0 | 110,050 | 3,286,130 | ||||||||||||||||||

| James C. Burmeister | 2018 | 386,250 | 0 | 123,389 | 0 | 247,598 | 0 | 28,362 | 785,599 | |||||||||||||||||

Senior Vice President, Chief Financial Officer(8) | 2017 | 271,354 | 100,000 | 76,808 | 47,057 | 145,859 | 0 | 25,752 | 666,830 | |||||||||||||||||

| Susan A. Kovach | 2018 | 361,503 | 0 | 110,512 | 0 | 204,799 | 0 | 35,959 | 712,773 | |||||||||||||||||

| Senior Vice President, General Counsel & Secretary | 2017 | 339,189 | 0 | 71,754 | 42,500 | 143,174 | 22,060 | 33,959 | 652,636 | |||||||||||||||||

| 2016 | 341,568 | 0 | 123,696 | 68,809 | 209,254 | 21,812 | 34,191 | 799,330 | ||||||||||||||||||

| Salvador Miñarro Villalobos | 2018 | 15,100 | 0 | 21,450 | 0 | 22,541 | 0 | 641,233 | 700,324 | |||||||||||||||||

Vice President, General Manager, US & Canada(9) | 2017 | 348,978 | 0 | 94,283 | 55,844 | 165,014 | 0 | 77,171 | 741,290 | |||||||||||||||||

| 2016 | 355,291 | 0 | 162,528 | 90,407 | 241,106 | 0 | 98,845 | 948,177 | ||||||||||||||||||

| William C. Mossing | 2018 | 300,000 | 0 | 69,095 | 0 | 141,474 | 0 | 103,391 | 613,960 | |||||||||||||||||

Senior Vice President, Chief Supply Chain Officer(10) | ||||||||||||||||||||||||||

| Sarah J. Zibbel | 2018 | 228,626 | 100,000 | 120,170 | 0 | 107,538 | 0 | 22,304 | 578,638 | |||||||||||||||||

Senior Vice President, Chief Human Resources Officer(11) | ||||||||||||||||||||||||||

| (1) | As to Mr. |

| (2) |

Represents the grant date fair value, in accordance with FASB ASC Topic 718, with respect to RSUs granted in |

| (3) | Represents the grant date fair value, in accordance with FASB ASC Topic 718, with respect to NQSOs granted in 2017 and 2016, respectively. The awards vest ratably over a four-year period from the date of grant or, in Mr. Burmeister's case, from the first day of employment. When Mr. Miñarro’s employment ended on January 15, 2018, vesting was accelerated with respect to all NQSOs that otherwise would have vested by January 15, 2019, and all other unvested NQSOs were forfeited. For more information, see Footnote 11, “Employee Stock Benefit Plans,” to the consolidated financial statements included in our Annual Report on Form 10-K filed with the SEC on February 27, 2019. The actual values received by the respective named executives depend on the number of NQSOs that actually vest, the number of shares with respect to which NQSOs are exercised and the price of our common stock on the date on which the NQSOs are exercised. |

| Represents |

| Represents the actuarial increase in pension value under our Salary Plan and our SERP. In |

| For |

| Named Executive | EDCP Matching Contribution ($)(a) | Tax Prep / Financial Planning ($)(b) | Housing Allowance or Relocation Assistance ($)(c) | Tax Gross-Up ($)(d) | Ground Transport ($)(e) | Airline Club Membership ($) | Annual Executive Physical Exam ($) | Legal Fees ($)(f) | Vacation ($)(g) | Total ($) | ||||||||||||||||||||

| W. Foley | 30,938 | 11,699 | 49,416 | 2,185 | 1,365 | 495 | 2,739 | 0 | 0 | 98,837 | ||||||||||||||||||||

| S. Streeter | 0 | 537 | 0 | 0 | 109 | 0 | 0 | 0 | 0 | 646 | ||||||||||||||||||||

| S. Buck | 12,113 | 14,000 | 0 | 0 | 1,036 | 479 | 0 | 0 | 3,587 | 31,215 | ||||||||||||||||||||

| A. Cerioli | 8,800 | 13,772 | 13,551 | 7,949 | 707 | 0 | 0 | 0 | 0 | 44,779 | ||||||||||||||||||||

| S. Kovach | 4,291 | 14,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 18,291 | ||||||||||||||||||||

| S. Miñarro | 0 | 3,255 | 51,192 | 10,195 | 342 | 0 | 0 | 23,126 | 0 | 88,110 | ||||||||||||||||||||

| J. White | 0 | 0 | 0 | 0 | 1,569 | 0 | 0 | 0 | 0 | 1,569 | ||||||||||||||||||||

| EDCP Matching Contribution | Tax Prep / Financial Planning | Housing Allowance, Commuting or Relocation Assistance | Tax Gross-Up | Ground Transport | Airline Club Membership | Annual Executive Physical Exam | Total | |||||||||

| Named Executive | ($)(a) | ($)(b) | ($)(c) | ($)(d) | ($)(e) | ($) | ($) | ($) | ||||||||

| W. Foley | 33,000 | 14,760 | 51,568 | 2,996 | 2,332 | 495 | 2,933 | 108,084 | ||||||||

| J. Burmeister | 0 | 8,761 | 0 | 0 | 163 | 495 | 2,443 | 11,862 | ||||||||

| S. Kovach | 4,552 | 14,760 | 0 | 0 | 261 | 0 | 0 | 19,573 | ||||||||

| S. Miñarro | 0 | 592 | 0 | 0 | 0 | 0 | 0 | 592 | ||||||||

| W. Mossing | 0 | 12,658 | 59,463 | 13,980 | 424 | 495 | 2,121 | 89,141 | ||||||||

| S. Zibbel | 0 | 9,948 | 0 | 0 | 1,506 | 0 | 0 | 11,454 | ||||||||

| (a) | Annual company matching contributions to our EDCP |

| (b) | The cost we paid for tax return preparation and financial planning for the respective named executives |

| (c) | As to Mr. Foley, represents |

| (d) | As to Mr. Foley, |

| (e) | Includes our incremental cost for ground transportation for personal and business trips from the Toledo, Ohio, area to the Detroit / Wayne County Metropolitan Airport. For personal trips, includes the entire cost that we incurred for such transportation. For business trips, includes the amount in excess of the amount to which the respective named executives would have been entitled as reimbursement for mileage and parking under our travel policy applicable to all employees. |

| Mr. Foley assumed his role as CEO effective January 12, 2016. Effective March 24, 2019, he retired from his role as CEO but continues to be employed by the Company as Executive Chairman. |

| (8) | Mr. Burmeister was hired on March 30, 2017. |

| (9) |

| (10) |

| (11) | Ms. |

Estimated Possible Payouts under Non-Equity Incentive Plan Awards(2) | All Other Stock Awards: Number of Shares of Stock or Units (#)(3) | All Other Option Awards: Number of Securities Underlying Options (#)(4) | Exercise or Base Price of Option Awards ($/Sh) | Grant Date Fair Value of Stock and Option Awards ($)(5) | |||||||||||||||||||||||

Named Executive | Plan Name | Award Date(1) | Grant Date(1) | Threshold ($) | Target ($) | Maximum ($) | |||||||||||||||||||||

| W. Foley | 2016 SMIP | 1/11/2016 | 165,000 | 825,000 | 1,856,250 | ||||||||||||||||||||||

| 2016 LTIP (cash) | 1/11/2016 | 247,500 | 990,000 | 1,980,000 | |||||||||||||||||||||||

| 2015 LTIP (cash) | 1/11/2016 | 326,700 | 653,400 | 1,306,800 | |||||||||||||||||||||||

| 2014 LTIP (cash) | 1/11/2016 | 81,675 | 326,700 | 653,400 | |||||||||||||||||||||||

| 2016 LTIP (RSUs) | 1/11/2016 | 2/25/2016 | 59,855 | 957,680 | |||||||||||||||||||||||

| 2016 LTIP (NQSOs) | 1/11/2016 | 2/25/2016 | 126,598 | 17.13 | 532,688 | ||||||||||||||||||||||

| 2016 Omnibus Plan | 10/28/2014 | 5/10/2016 | 4,551 | 80,007 | |||||||||||||||||||||||

| S. Streeter | 2016 SMIP | 1/11/2016 | 24,057 | ||||||||||||||||||||||||

| 2016 LTIP (cash) | 1/11/2016 | 9,623 | |||||||||||||||||||||||||

| S. Buck | 2016 SMIP | 2/8/2016 | 67,498 | 337,488 | 759,348 | ||||||||||||||||||||||

| 2016 LTIP (cash) | 2/8/2016 | 66,500 | 266,000 | 532,000 | |||||||||||||||||||||||

| 2016 LTIP (RSUs) | 2/8/2016 | 2/25/2016 | 16,082 | 257,312 | |||||||||||||||||||||||

| 2016 LTIP (NQSOs) | 2/8/2016 | 2/25/2016 | 34,015 | 17.13 | 143,125 | ||||||||||||||||||||||

| A. Cerioli | 2016 SMIP | 2/8/2016 | 48,720 | 243,601 | 548,102 | ||||||||||||||||||||||

| 2016 LTIP (cash) | 2/8/2016 | 48,000 | 192,001 | 384,002 | |||||||||||||||||||||||

| 2016 LTIP (RSUs) | 2/8/2016 | 2/25/2016 | 11,608 | 185,728 | |||||||||||||||||||||||

| 2016 LTIP (NQSOs) | 2/8/2016 | 2/25/2016 | 24,553 | 17.13 | 103,312 | ||||||||||||||||||||||

| S. Kovach | 2016 SMIP | 2/8/2016 | 34,157 | 170,784 | 384,264 | ||||||||||||||||||||||

| 2016 LTIP (cash) | 2/8/2016 | 31,970 | 127,878 | 255,756 | |||||||||||||||||||||||

| 2016 LTIP (RSUs) | 2/8/2016 | 2/25/2016 | 7,731 | 123,696 | |||||||||||||||||||||||

| 2016 LTIP (NQSOs) | 2/8/2016 | 2/25/2016 | 16,353 | 17.13 | 68,809 | ||||||||||||||||||||||

| S. Miñarro | 2016 SMIP | 2/8/2016 | 42,635 | 213,175 | 479,644 | ||||||||||||||||||||||

| 2016 LTIP (cash) | 2/8/2016 | 42,005 | 168,019 | 336,038 | |||||||||||||||||||||||

| 2016 LTIP (RSUs) | 2/8/2016 | 2/25/2016 | 10,158 | 162,528 | |||||||||||||||||||||||

| 2016 LTIP (NQSOs) | 2/8/2016 | 2/25/2016 | 21,486 | 17.13 | 90,407 | ||||||||||||||||||||||

| J. White | 2016 SMIP | 2/8/2016 | 79,931 | 399,656 | 899,226 | ||||||||||||||||||||||

| 2016 LTIP (cash) | 2/8/2016 | 78,750 | 315,000 | 630,000 | |||||||||||||||||||||||

| 2016 LTIP (RSUs) | 2/8/2016 | 2/25/2016 | 19,045 | 304,720 | |||||||||||||||||||||||

| 2016 LTIP (NQSOs) | 2/8/2016 | 2/25/2016 | 40,281 | 17.13 | 169,491 | ||||||||||||||||||||||

| Grants of Plan-Based Awards Table |

Estimated Possible Payouts under Non-Equity Incentive Plan Awards(2) | All Other Stock Awards: Number of Shares of Stock or Units | Grant Date Fair Value of Stock and Option Awards | |||||||||||||||||||

| Named Executive | Plan Name | Award Date(1) | Grant Date(1) | Threshold | Target | Maximum | |||||||||||||||

| ($) | ($) | ($) | (#)(3) | ($)(4) | |||||||||||||||||

| W. Foley | 2018 SMIP | 2/15/18 | 41,250 | 825,000 | 1,650,000 | ||||||||||||||||

| 2018 LTIP (cash) | 2/15/18 | 618,750 | 1,237,500 | 2,475,000 | |||||||||||||||||

| 2018 LTIP (RSU) | 2/6/18 | 2/28/18 | 159,677 | 814,353 | |||||||||||||||||

| J. Burmeister | 2018 SMIP | 2/15/18 | 11,588 | 231,750 | 463,500 | ||||||||||||||||

| 2018 LTIP (cash) | 2/15/18 | 93,750 | 187,500 | 375,000 | |||||||||||||||||

| 2018 LTIP (RSU) | 2/6/18 | 2/28/18 | 24,194 | 123,389 | |||||||||||||||||

| S. Kovach | 2018 SMIP | 2/15/18 | 9,038 | 180,752 | 361,504 | ||||||||||||||||

| 2018 LTIP (cash) | 2/15/18 | 83,968 | 167,936 | 335,872 | |||||||||||||||||

| 2018 LTIP (RSU) | 2/6/18 | 2/28/18 | 21,669 | 110,512 | |||||||||||||||||

| S. Miñarro | Omnibus Plan (RSU) | 1/9/18 | 1/15/18 | 3,000 | 21,450 | ||||||||||||||||

| W. Mossing | 2018 SMIP | 2/15/18 | 7,500 | 150,000 | 300,000 | ||||||||||||||||

| 2018 LTIP (cash) | 2/15/18 | 52,500 | 105,000 | 210,000 | |||||||||||||||||

| 2018 LTIP (RSU) | 2/6/18 | 2/28/18 | 13,548 | 69,095 | |||||||||||||||||

| S. Zibbel | 2018 SMIP | 3/7/18 | 5,716 | 114,313 | 228,626 | ||||||||||||||||

| 2018 LTIP (cash) | 3/7/18 | 49,729 | 99,458 | 198,916 | |||||||||||||||||

| 2018 LTIP (RSU) | 3/7/18 | 5/2/18 | 14,000 | 71,470 | |||||||||||||||||

| Omnibus Plan (RSU) | 3/7/18 | 5/2/18 | 10,000 | 48,700 | |||||||||||||||||

| (1) | For |

| (2) | Represents the range, as estimated on the award date, of possible cash awards under (a) our |

| (a) | Under our SMIP, each named executive is eligible for an annual incentive award in an amount up to |

Target Award as a Percentage of Anticipated Full-Year Base Salary | ||

| Named Executive | ||

| W. Foley | ||

| S. Kovach | ||

| W. Mossing | 50% | |

| S. | ||

| Revenue Growth (Net Sales) | Adjusted Cash Earnings | |||||||

Full Year Net Sales | Percent of Targeted Net Sales | Performance Level | Payout Percentage | Full Year Cash Earnings | Percent of Targeted Cash Earnings | Performance Level | Payout Percentage | |

| $880,000 | 104.9% | Maximum | 200% | $131,076 | 110.0% | Maximum | 200% | |

| $839,138 | 100.0% | Target | 100% | $119,160 | 100.0% | Target | 100% | |

| $800,000 | 95.3% | Threshold | 40% | $95,328 | 80.0% | Threshold | 50% | |

| < $800,000 | < 95.3% | Below Threshold | 0% | < $95,328 | < 80.0% | Below Threshold | 0% | |

| (b) | Under the performance cash component of our |

| Named Executive | 2016 Target Long-Term Award as a Percentage of Annualized Base Salary (%) | 2016 LTIP Performance Cash Target as Percentage of Annualized Base Salary (%) | ||

| W. Foley | 300 | 120 | ||

| S. Streeter | 300 | 120 | ||

| S. Buck | 140 | 56 | ||

| A. Cerioli | 120 | 48 | ||

| S. Kovach | 95 | 38 | ||

| S. Miñarro | 120 | 48 | ||

| J. White | 150 | 60 | ||

| 2018 Target Long-Term Award as a Percentage of Annualized Base Salary | 2018 LTIP Performance Cash Target as a Percentage of Annualized Base Salary | |||

| Named Executive | ||||

| W. Foley | 300% | 150% | ||

| J. Burmeister | 100% | 50% | ||

| S. Kovach | 95% | 48% | ||

| W. Mossing | 70% | 35% | ||

| S. Zibbel | 70% | 32% | ||

| Basis Points Above or Below 2016 Targeted ROIC | Payout Score (%) | |||

| +100 | 200 | |||

| 0 | 100 | |||

| -150 | 25 | |||

Less than -150 | 0 | |||

| Percent of 2018 Targeted Adjusted EBITDA | Payout Score | |

| 112.5% | 200% | |

| 0 | 100% | |

| 87.5% | 50% | |

| Less than 87.5% | 0% | |

| (3) | Represents grants of RSUs made under our |

| (4) |

| Option Awards | Stock Awards | ||||||||||||||||||||

| Named Executive | Award Date(1) | Grant Date(1)(2) | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable(3) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#)(3)(4) | Market Value of Shares or Units of Stock That Have Not Vested ($)(5) | |||||||||||||

| W. Foley | 1/11/2016 | 2/25/2016 | 0 | 126,598 | 17.13 | 2/25/2026 | 59,855 | 1,164,778 | |||||||||||||

S. Streeter(6) | 12/9/2013 | 12/16/2013 | 240,829 | 0 | 21.29 | 1/11/2017 | |||||||||||||||

S. Buck(7) | 7/6/2012 | 8/1/2012 | 33,389 | 0 | 13.96 | 3/31/2017 | 0 | 0 | |||||||||||||

| 2/11/2013 | 2/22/2013 | 8,953 | 0 | 19.02 | 2/22/2023 | 0 | 0 | ||||||||||||||

| 2/17/2014 | 2/24/2014 | 5,370 | 0 | 23.02 | 2/24/2024 | 0 | 0 | ||||||||||||||

| 2/16/2015 | 3/2/2015 | 2,246 | 0 | 38.06 | 3/31/2017 | 0 | 0 | ||||||||||||||

| A. Cerioli | 10/27/2014 | 12/1/2014 | 2,746 | 2,745 | 29.50 | 12/1/2024 | 4,178 | 81,304 | |||||||||||||

| 2/16/2015 | 3/2/2015 | 1,321 | 3,963 | 38.06 | 3/2/2025 | 2,934 | 57,096 | ||||||||||||||

| 6/11/2015 | 6/12/2015 | 1,875 | 36,488 | ||||||||||||||||||

| 2/8/2016 | 2/25/2016 | 0 | 24,553 | 17.13 | 2/25/2026 | 11,608 | 225,892 | ||||||||||||||

| S. Kovach | 2/4/2008 | 2/15/2008 | 3,621 | 0 | 15.35 | 2/15/2018 | |||||||||||||||

| 2/7/2011 | 2/10/2011 | 3,625 | 0 | 17.00 | 2/10/2021 | ||||||||||||||||

| 2/6/2012 | 2/17/2012 | 4,624 | 0 | 13.95 | 2/17/2022 | ||||||||||||||||

| 2/11/2013 | 2/22/2013 | 5,177 | 1,725 | 19.02 | 2/22/2023 | 1,513 | 29,443 | ||||||||||||||

| 2/17/2014 | 2/24/2014 | 3,207 | 3,206 | 23.02 | 2/24/2024 | 2,817 | 54,819 | ||||||||||||||

| 2/16/2015 | 3/2/2015 | 1,172 | 3,513 | 38.06 | 3/2/2025 | 2,601 | 50,615 | ||||||||||||||

| 2/8/2016 | 2/25/2016 | 0 | 16,353 | 17.13 | 2/25/2026 | 7,731 | 150,445 | ||||||||||||||

| S. Miñarro | 2/4/2008 | 2/15/2008 | 3,200 | 0 | 15.35 | 2/15/2018 | |||||||||||||||

| 2/9/2009 | 2/27/2009 | 3,500 | 0 | 1.01 | 2/27/2019 | ||||||||||||||||

| 2/8/2010 | 2/11/2010 | 6,000 | 0 | 10.13 | 2/11/2020 | ||||||||||||||||

| 12/6/2010 | 12/31/2010 | 20,000 | 0 | 15.47 | 12/31/2020 | ||||||||||||||||

| 2/7/2011 | 2/10/2011 | 7,000 | 0 | 17.00 | 2/10/2021 | ||||||||||||||||

| 2/6/2012 | 2/17/2012 | 7,500 | 0 | 13.95 | 2/17/2022 | ||||||||||||||||

| 7/5/2012 | 8/1/2012 | 3,597 | 0 | 13.96 | 8/1/2022 | ||||||||||||||||

| 2/11/2013 | 2/22/2013 | 5,939 | 1,979 | 19.02 | 2/22/2023 | 1,734 | 33,744 | ||||||||||||||

| 2/17/2014 | 2/24/2014 | 3,291 | 3,291 | 23.02 | 2/24/2024 | 2,891 | 56,259 | ||||||||||||||